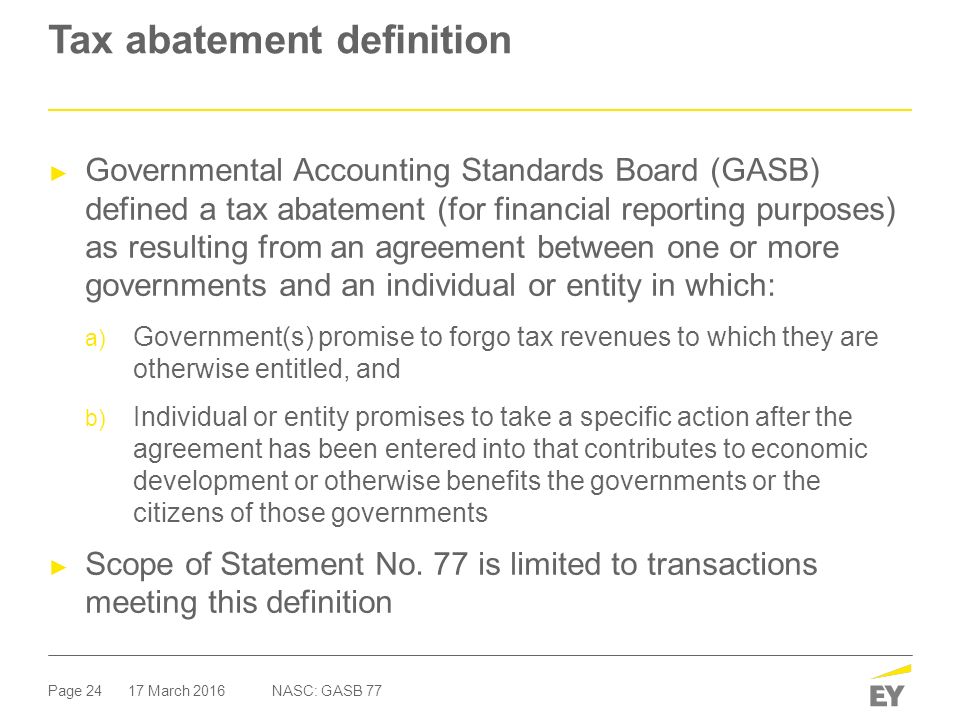

tax abatement definition government

Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development. An abatement is a tax break offered by a state or local government on certain types of real estate or business opportunities.

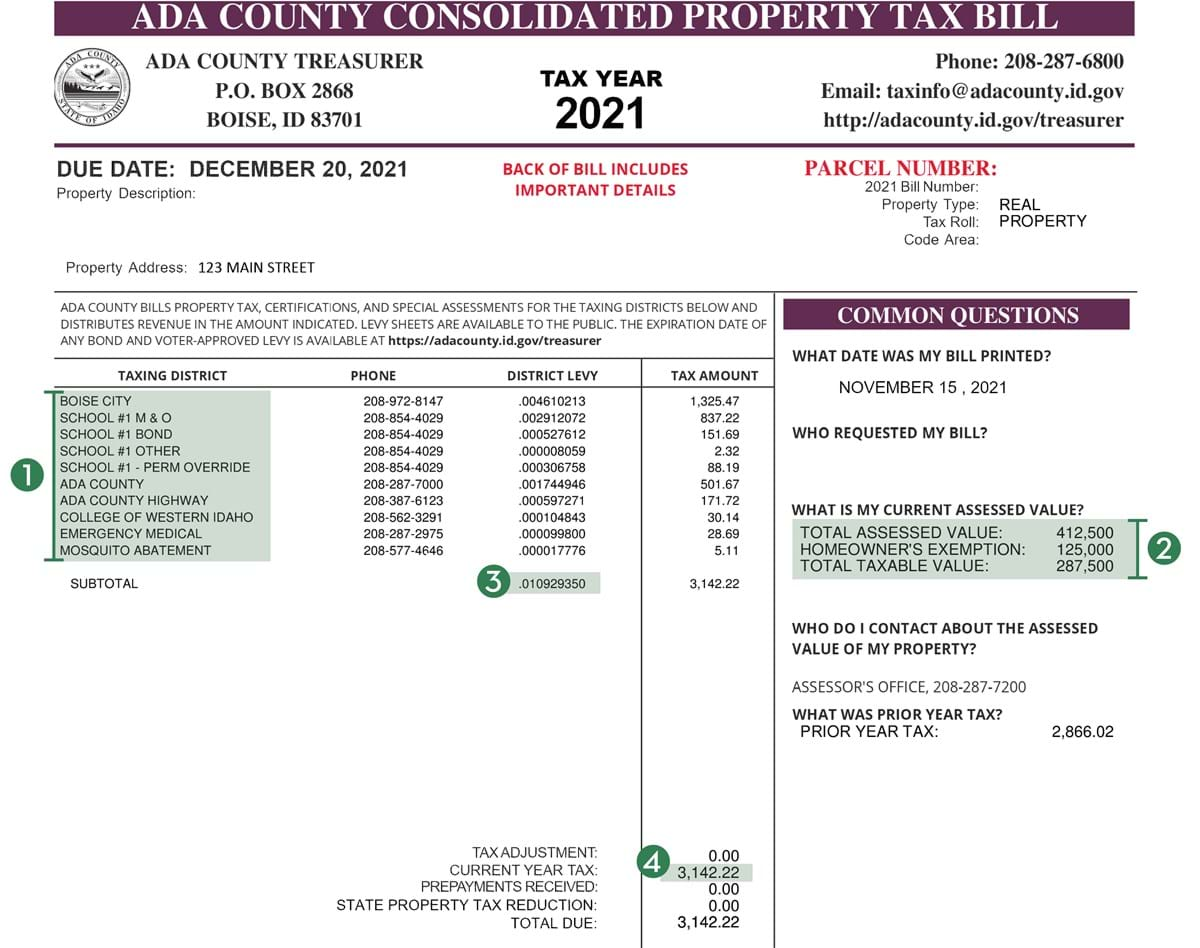

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

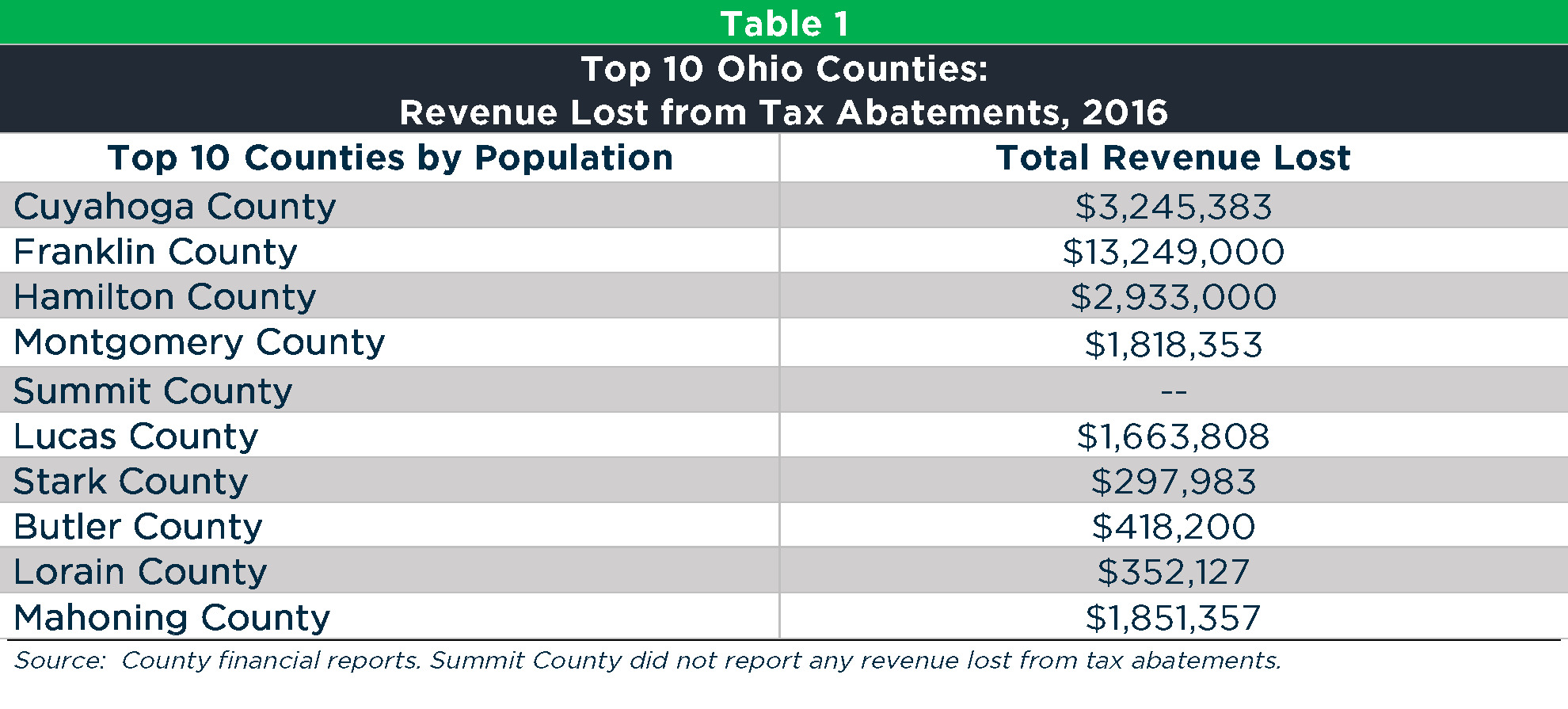

. 77 Tax Abatement Disclosures that will require those state and local. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. It is offered by.

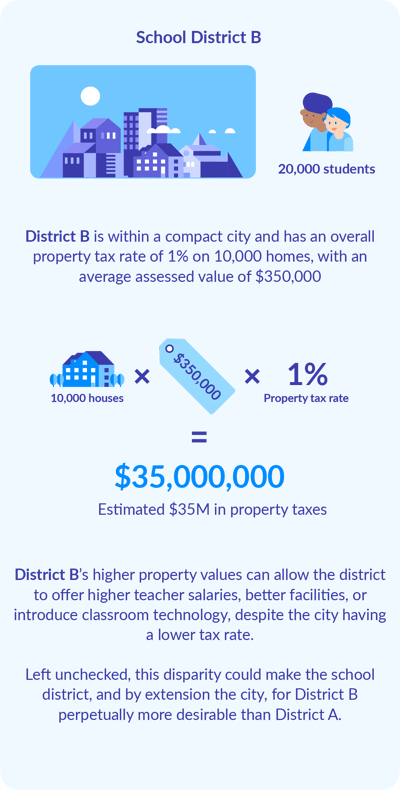

Property Tax Abatement Act Tax Code Chapter 312 Overview. A property tax abatement refers to when the government provides a tax break financial incentive or tax subsidy reducing the amount of taxes that you must pay on. You may qualify for.

This may be in a piece of. More from HR Block. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic.

A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property. Tax Penalty Abatement. What are Tax Abatements.

Tax Abatement is a property tax incentive that entities issue to significantly reduce or eliminate taxes that an owner pays. A tax abatement is a local agreement between a taxpayer and a taxing unit that exempts all or part of the increase. For example if one receives a tax credit for purchasing a house one receives tax abatement.

What Is Tax Abatement. Such arrangements are known as tax abatements. A governing body may use an abatement sometimes called.

A reduction of taxes for a certain period or in exchange for conducting a certain task. The tax abatement is an incentive to encourage people to redevelop and move into these areas. Penalty abatement is a federal relief program designed to help those whove made a mistake and have incurred penalties.

The main intention of the government bodies to offer tax abatement programs on real estate properties is to fascinate the buyers to buy property in locations that have lesser demand. If the IRS has. Recently the GASB published GASB Statement No.

Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development. A tax abatement is a property tax incentive offered by government agencies to decrease or eliminate real estate taxes in a specified location. Whether revitalization efforts will ultimately prove successful is a big.

The most common ad valorem taxes are property taxes levied on. Abatements can range in length from a few. County Abatement means the amount equal to that which is calculated in each tax-payable year as follows.

The Net Tax Capacity of the Development Property as improved by the Minimum.

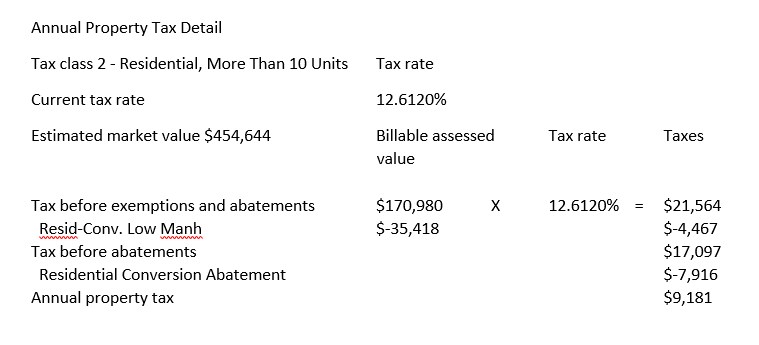

Understanding California S Property Taxes

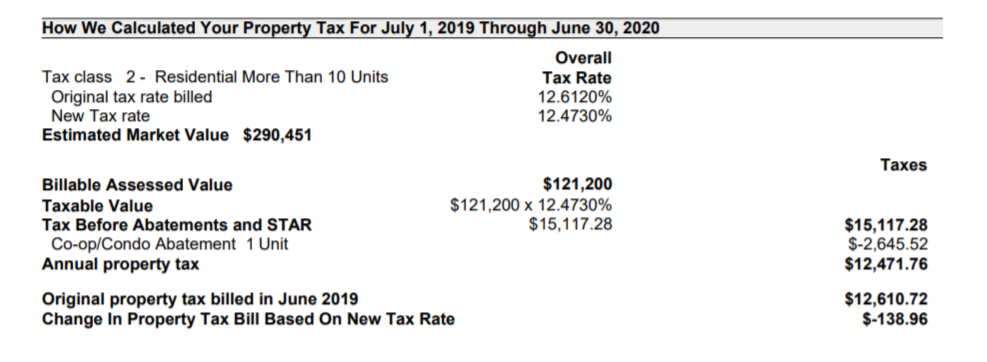

Nyc Residential Property Tax Guide For Class 2 Properties

Chapter 9g Abatements Alabama Department Of Revenue

What Is A Tax Abatement Smartasset

Local Tax Abatement In Ohio A Flash Of Transparency

Gasb 77 Tax Abatement Disclosure And Required Governmental Considerations Nasc Annual Conference Salt Lake City Utah 17 March 2016 Presenter Joe Huddleston Ppt Download

Appealing Property Taxes How To Challenge Your Tax Assessment

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition

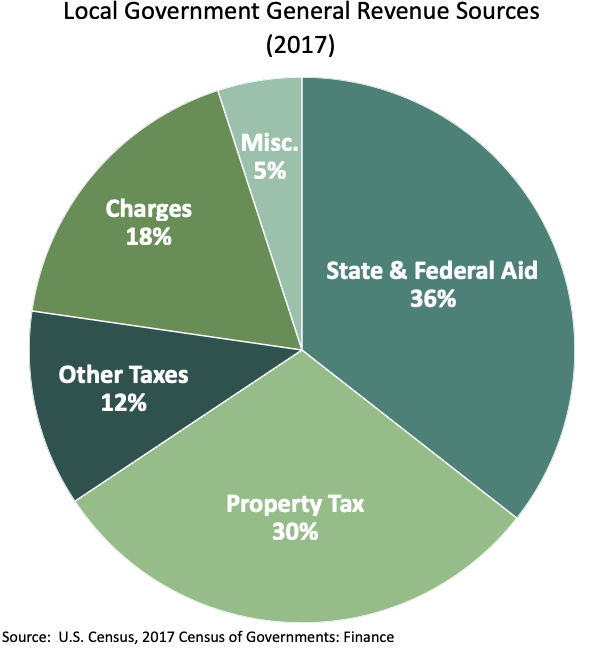

How State Local Dollars Fund Public Schools

How Much Is The Coop Condo Tax Abatement In Nyc

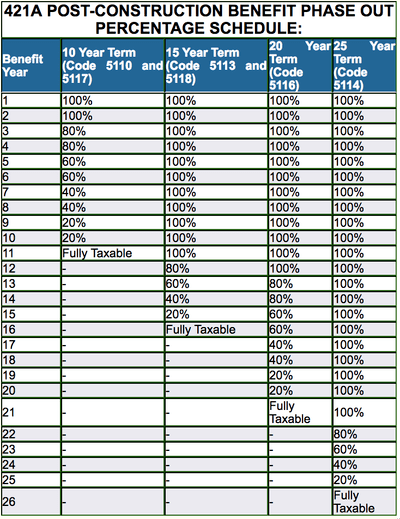

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

Tax Abatements Alabama Department Of Revenue

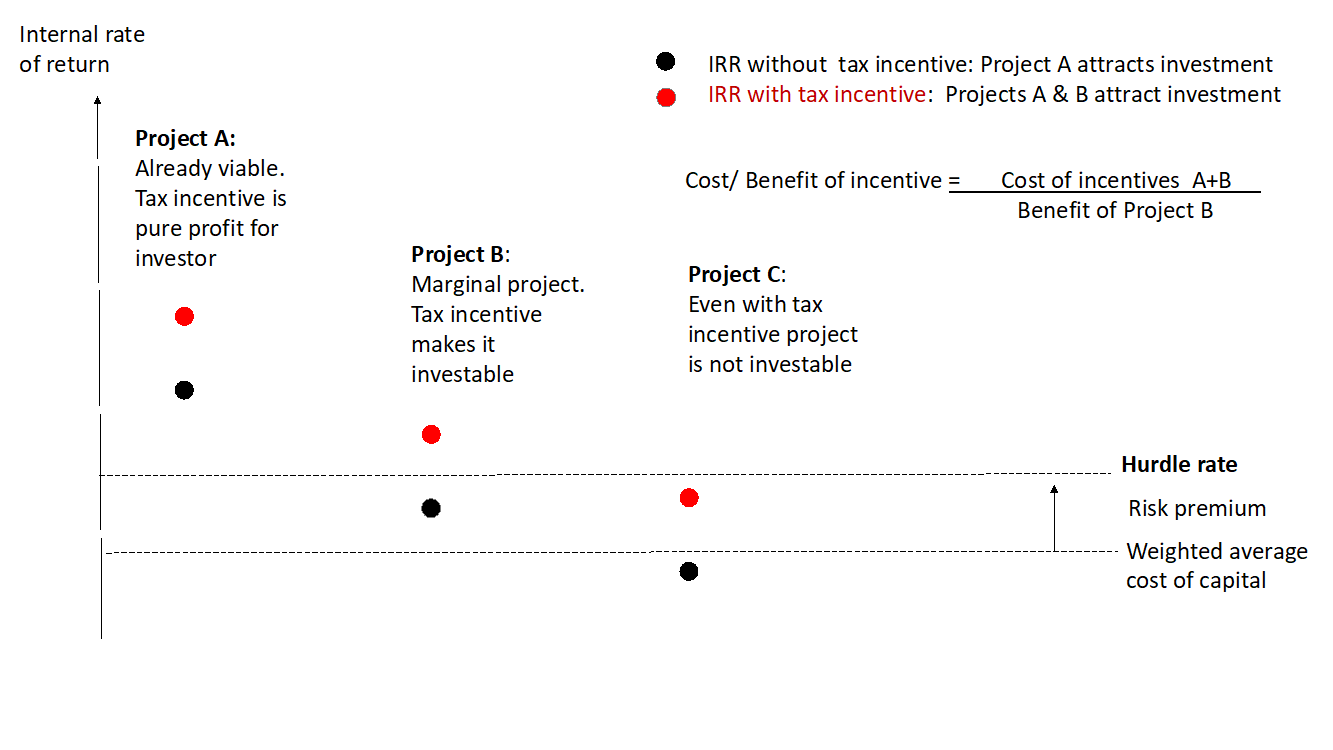

The Good The Bad And The Ugly How Do Tax Incentives Impact Investment Center For Global Development Ideas To Action

Breaking News 77 80 81 83 84 85 And 86 October 12 Ppt Download

Efficient And Equitable Tax Systems Lincoln Institute Of Land Policy